I try and read as much as possible when time allows. Certain topics fascinate me, over the last few years, it’s been the confluence of tech, strategy and finance. This book covers all these topics. It’s a fascinating story of his evolution from a teen wunderkind defying his parents to put together his fledgeling startup, to a mature leader making huge bets on the future of the technology industry and market as a whole. Use of analepsis, in my view, made it a more compelling read. As the various crisis points in the story are brought forth, it’s clear that his history and principles guide Dell Technologies in the new challenges it faced. Whether it was the above board handling of the go private transaction, which was uncomfortable for Michael, but ultimately saved the deal when it faced litigation, or keeping his word to honor the legacy of the EMC founders, principles mattered and principles paid a dividend. A few themes emerge, but one of the biggest is that skulduggery is short term profitable and long term fruitless. Doing business with integrity, ensuring everyone wins, is its own reward. Michael is an autodidact whose curiosity ends up being the engine of transformation for the company. From not having a good sense of his cash position in the early days, to use of more sophisticated tools (such as a tracking stock), the evolution is interesting to read. The book is full of interesting nuggets on grit, talent acquisition, retention, sales (interesting that Michael still meets with customers), innovation and a good primer on corporate finance. It’s a recommended read for anyone in business / technology.

A Critique of Safaricom’s Recent Bandwidth Policy

There has been a lot of opprobrium about the recently introduced fair use policy by Safaricom. In this post, I’ll explain why it is logical to have this, why “unlimited” internet isn’t really unlimited, delve into the business model and cost structure. Finally, I’ll cover the world according to Safaricom and other ISPs, and why we have so few Fiber to the Home (FTTH) providers.

A fair use policy / fair access policy, is a bandwidth limit that Internet Service Providers (ISPs) use to attempt to equalise internet service between customers. Safaricom has poorly communicated its position on the Fair Use Policy (FUP) and also poorly executed it. It has also not considered all the tools that it has at its disposal, to resolve the issues that it has.

Fair Use – Unlimited isn’t Unlimited

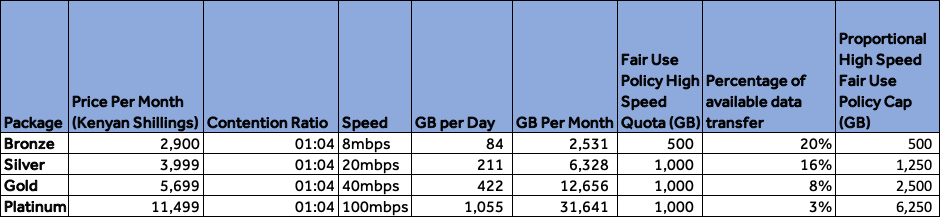

Firstly, let’s cover why you need a fair use policy. Users get internet connections and are told or assume they are unlimited, due to problematic branding on the part of the ISPS – they are not. I’ll use the Safaricom Bronze package as an example here. It’s an 8Mbps link (8 megabits per second), at KES 2,900 a month, with a 500GB (gigabyte) fair use policy limit. Fixed internet speed is typically indicated in bits (small b) per second, not bytes (big B) ( 8 bits make one byte, so the 8mbps (8 megabit per second) link you get from your ISP (note the lower case letter b) translates to 1MBps (one megabyte per second – note the upper case letter B ). This means that I can transfer one megabyte, every second through that link. I pay for that link every 30 days meaning, that the maximum data I can transfer is the duration of the period vs the maximum throughput. If you transfer one megabyte every second, you transfer 60 megabytes a minute, 3,600 megabytes an hour, 86,400 megabytes a day, or , roughly 84GB. Assume a 30 day month, you get 2,531.25 GB, or 2.47TB, a month, through that link, that’s the maximum amount of bandwidth you can transfer. So, you do pay for a capped amount of data.

Now, the second thing: to make internet connectivity affordable for the consumer, Safaricom distributes the bandwidth bill among multiple homes. An 8mbps (megabit) link from Safaricom or any other corporate ISP, that’s dedicated, costs significantly more than the home link; it’s upwards of 50,000 KES per month. International bandwidth – the connectivity to undersea cables that eventually gets to consumers – is expensive. Granted, Safaricom is the largest consumer of connectivity in Kenya, so they get significant discounts, but they do also invest heavily in their network, datacenters and have to invest in redundant undersea links that kick in whenever there’s a undersea fibre cut. It’s expensive. Safaricom says they share the link between four homes. It’s unfair to the remaining three homes if one of the homes redistributes the link; each of the other homes get less bandwidth. Safaricom, have capped full speed access at 500GB; once you consume that much data, they don’t disconnect you, they simply reduce your speed to 1mbps. Let me demonstrate: that 8mbps link is shared among 4 homes, meaning that the 2,531.25 GB used in the example earlier is shared – that’s the total amount of data the four homes can access, so each home should get 632.75GB. Capping high speed usage at 500GB (20% of the total available consumption) and leaving some slack is actually quite fair; each home can theoretically consume up to 632.75GB in four weeks.. If you hit your 500GB limit, Safaricom will reduce your bandwidth from 8mbps to 1mbps. If you hit this within three weeks, a speed reduction to 1mbps from 8mbps still gives you 73GB for the last week (assuming 24/7 access), with 573GB consumed in total. If I hit the total in 2 weeks (assuming 24/7 access), you will go over what was to be fairly allocated, consuming 646GB. Now, the bigger issues is that the fair use policy seems punitive once you get more bandwidth and this is where I feel Safaricom really dropped the ball.

See the table above. Even when you have 12 times the bandwidth (100mbps vs 8mbps), you only get twice the amount of data under the fair use policy. It’s not congruent and is punitive for higher value customers, which makes no sense. A customer who pays Safaricom 11,499 KES, gets as much data as one paying 3,999, but with higher throughput (meaning they will exhaust their quota faster). This doesn’t make sense. The allocation should be proportional. On the last column, I demonstrate what a fairer allocation of transfer looks like, following the same allocation policy as their bronze link.

Safaricom’s explanation, that the FUPs were introduced to make the economics untenable for resellers, therefore makes sense.This intervention is not meant to ensure lower congestion for ordinary users; it was meant to push resellers (people who get one Safaricom link, split it up into smaller units, and sell it to third parties) out of business. This explains why it’s punitive to the users who consume more bandwidth – those links are also the most popular with the resellers. Resellers get the high bandwidth Safaricom links and resell them, which goes against Safaricom’s terms of service and, I believe, CAK regulations.

Additionally, sharing bandwidth only saves the customer money on international bandwidth (the connection to the undersea cables I mentioned earlier), but they don’t reduce the cost of installing and maintaining the infrastructure that connects the user to the internet. This is still a very expensive undertaking.

Internet is expensive – VERY EXPENSIVE

Internet infrastructure costs a lot of money, like a lot a lot. Customers are very price sensitive and it takes very long to recoup infrastructure investments. Investors, though, love the business for its consistent recurring cashflows and longer term value of the customers. Zuku, for instance, has raised over $400m (40 billion shillings) to roll out its network, over the last 12 years*. Safaricom spent 20 billion shillings – they have the added advantage of having the telco business to underwrite their backbone infrastructure. International connectivity is equally expensive; as an example, Seacom, the first undersea cable in this region, was seeded with around $650m (65 billion shillings). Liquid Telecom, one of the biggest players across Africa, has so far raised $1.6B (160 billion shillings) invested in its network and datacenter infrastructure across the continent.

A business that provides fibre to the home has to invest in its core network infrastructure, consumer end point devices (the device in the house), installation, international bandwidth, servers, datacenter infrastructure, etc. Rolling out fiber is very dirty work; you have to negotiate with multiple government bodies (county authorities, power utilities, road agencies) and you have to literally dig up the ground, at times through sewer lines, at a cost of over 1 million KES per kilometer. It’s very expensive to get that fiber to an apartment building. They also have to pay network engineers, support staff, general and administrative staff, cost of finance, tax, etc. All those costs are baked into the price charged. Higher value customers obviously give them more margin, but they are rare. Most customers are in the lower price bracket, so Safaricom has to make up the difference in volume.

So for Safaricom or any other player, an unscrupulous customer who is reducing demand in a particular apartment complex that they have invested hundreds of thousands of shillings to reach is simply unacceptable. It’s indirectly a form of theft, where this individual will profit from the investment made by Safaricom and keep all the margin, while Safaricom loses money. This also violates the terms of service.

Fixing the wrong problem

The path to Safaricom chose – to limit bandwidth to resellers – exacerbates this problem by increasing churn among well meaning clients who feel poorly treated. The right intervention is to actively reduce this reselling (which is generally a signal of pent up demand and an affordability issue). This isn’t the first time this problem is being experienced; there are solutions that they can reference. Incidentally, the industry had its birth through this very same problem that Safaricom is experiencing. This was first a problem for free to air television stations in the US that were unable to roll out their signals to hard to reach areas. TCI and other cable companies, rolled out cable (and this became the birth of cable TV and eventually cable internet) and rebroadcast the TV signals, much to the chagrin of the free to air stations that felt that the cable companies were charging people for the stations’ content. Eventually, these free to air companies started cable companies and cable companies developed their own content (HBO is one such company, born from a cable company).

The reselling of Safaricom’s links indicates one of two things. Firstly, they may have unmet demand – in this case, users are willing to pay, but they aren’t rolling out the fibre fast enough. Existing consumers shouldn’t be punished for an internal capacity issue. Secondly, they may be too expensive – this is a harder problem to solve. There are, however, some solutions that they may want to consider.

Safaricom has a robust wholesale department. They sell bandwidth to other ISPs. Resellers who are found reselling consumer links can be given one of two options: (i) get blacklisted by Safaricom with the connection summarily disconnected for violating Safaricom’s terms of service or, (ii) they could simply pay a fairer fee to Safaricom for wholesale connectivity. It should also be fairly straightforward to sign up for this service. This allows Safaricom to recoup the cost of pulling fibre to that area. They won’t have to bear the costs of serving the customer.

Another approach is to invest in smaller ISPs willing to serve areas where Safaricom won’t be able to justify the investment. This is effectively the approach TCI took in from 1970 to 1998, when they were bought by AT&T. Safaricom can assist these companies with technical capacity, cheaper infrastructure and reduce the incentives for people to resell these links. They can maintain a right to buy the companies at a fair value at a point where they believe they can integrate them to their more premium offering. It’s a little more difficult, but it protects their brand and the customers they’ve spent a fortune acquiring .

Ultimately, Safaricom needs to be concerned about its current customers and not punish them for the mischief of a few unscrupulous actors.

*A fun fact is that Liberty Media, partially owned by John Malone, formerly CEO of TCI, around which Zuku seems to be modelled, owns part of Zuku and also owns Formula One.

The Future of Cloud in Africa is Managed Services

The global cloud market has been accelerating. Estimates are that, by 2030, 90% of all computing workloads will be in the cloud. Africa has paradoxically been at the forefront – AWS was developed in South Africa – while at the same time lagged behind the global cloud movement. The first hyper-scale cloud provider to launch on the continent was Microsoft Azure (in March 2019) followed by AWS shortly thereafter.

As cloud computing adoption accelerates in Africa, I see the market becoming dominated by indigenous cloud service providers and not cloud technology providers. The difference between the two is that the technology providers write the software that runs the cloud and either sell it as an integrated service, including compute, networking and storage (AWS, Microsoft, Google) or sell the software directly to the end user (VMware, Microsoft, Citrix), whereas cloud service providers provide professional services on top of these platforms, whether it’s public or private clouds (Rackspace, Accenture, Dimension Data). The profits in the cloud technology space accrue to these few companies.

The reason for this shift is simply scale; the economics of running a cloud technology business aren’t friendly to smaller companies. AWS (Amazon.com), Microsoft (Bing, Office 365, Hotmail) and Google (Google.com, Gmail, Youtube) were able to underwrite their datacenter, network infrastructure with their own web properties. This meant that the barrier to entry was much higher, as they all had a level of scale that allowed them to have lower operating costs per unit. These providers also have large teams of engineers already running their existing properties. They negotiate directly with Intel for chipsets, have lower bandwidth costs, lower per-unit infrastructure costs, and lower human resource costs.

The flywheel

Cloud technology providers were able to make significant investments in their cloud platforms, building tools and APIs that allowed developers to automate on the infrastructure. This gave them scale and feedback to develop and improve their platforms, which attracted more developers and workloads, allowing them to keep pulling away from the market and attracting more and more workloads. Developers eventually specialised on one of these platforms and comitted to them.

They have now reached a level of scale that makes it a Herculean task to compete directly with them both in terms of software features and hardware scale and infrastructure. As of 2020, the top 5 cloud technology providers accounted for 80% of the market. This makes the cloud business a particularly difficult space to operate in, as there is downward margin pressure as the global providers are cutting down prices, while capital expenditure needs to grow to achieve a level of scale that allows one to compete. There just isn’t enough cashflow to invest to scale.

Additionally, most cloud providers have to contend with building a large engineering team to build out the features and automation that clients need, which is expensive, or simply using existing proprietary platforms, which generally end up acting like a tax on the cloud platform. There’s very little wiggle room for getting a competitive cloud running with enough money to build out the features needed to compete and keep growing.

So, this has led to the paradox of having very few large scale cloud vendors in Africa. The capital required to run a cloud platform at scale isn’t congruent with the demonstrable demand for the cloud platform at these cost structures. Put another way, few people are willing to pay the higher price required to keep the lights on in these cloud platforms, so the providers need to focus on an alternative path to generate profits. Ultimately, consumers are voting with their wallets and saying that latency is a less important consideration than the sticker price of the service. This means that the benefits of running the infrastructure will accrue to the largest providers who can have the lowest cost structure.

The future

Thus, the future for indigenous cloud firms in Africa will be managed services (cloud service providers). There will be a few larger providers who run infrastructure, but they will mostly be enterprise focused and who can bundle the cost of the more expensive cloud infrastructure that they are running into the managed services they are offering their customers. Ultimately the customers will be consuming the managed services; the infrastructure will be invisible to them. Adoption will depend on how good all service providers are and how well they are able to guide clients on their journey to the cloud. Quality managed services providers will ultimately be the biggest catalyst to cloud adoption in Africa. Eventually, the hyper-scale providers will expand their datacenter footprint across the continent, as adoption accelerates, which will create even more opportunities for the managed service providers.